|

|

Hyun and Chung

|

Several arms of Hyundai Group in position to take leadership role

With Hyundai Securities Co. expressing interest in acquiring Hyundai Engineering & Construction Co. and Hyundai Heavy Industries appointing former executives of the engineering firm as its vice presidents, competition for control over Hyundai Group holdings has become heated.

At a May 23 stockholders’ meeting, Hyundai Securities laid out a plan for a large-scale increase in capital by upping the number of circulating shares from 300 million to 600 million. "As the measure to expand circulating shares has been passed at the general meeting of stockholders, the issuance of new shares is possible now through a decision by the board of directors," Mr. Kim said, indicating the possibility of issuing enough new shares to fund the acquisition of Hyundai Engineering & Construction Co. (HECC).

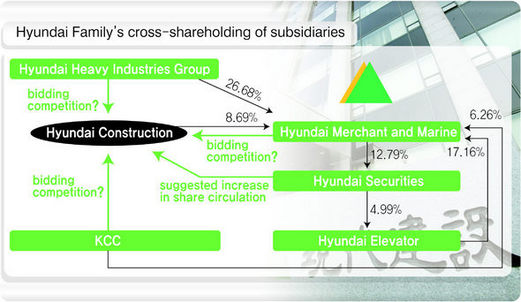

Hyundai Securities so far has denied the rumor that it will issue new shares to secure money to take over HECC. But at the press conference following the stockholders meeting, Kim Ji-wan, president of Hyundai Securities, hinted at the possibility of his group participating in the takeover of HECC. Some experts in the market said that the group’s issuing of new Hyundai Merchant & Marine Co. (HMM) shares was to fund the HECC takeover, but it did not produce enough capital, so other subsidiaries of Hyundai Group, including Hyundai Elevator, will issue new shares as well.

|

In the meantime, on May 22 Hyundai Heavy Industries (HHI) appointed Han Dong-jin, former vice president of HECC, as vice president of its plant division. HHI reportedly is stepping up efforts to bring in additional former executives of HECC. HHI said, "The appointment of Han has nothing to do with the takeover of HECC." However, market observers say that HHI has started to lay the groundwork for acquisition of HECC. Many experts forecast that HHI will also participate in the issuance of new shares of HMM scheduled for June. Since HMM, Hyundai Securities and Hyundai Elevator, all of which are subsidiaries of Hyundai Group, are participating in cross-shareholding with each other, with the acquisition of HECC any of the three companies stands to hold a dominant market share, thus effectively taking the reins of Hyundai Group. Some experts voiced criticism that the Hyundai family’s dispute over managerial control is irrelevant to stockholders’ interest, saying it stems from a regard of corporations as managerial property, rather than that of the stockholders. "The dispute between Hyundai Group and HHI has been raised on behalf of the largest shareholders’ interests, having nothing to do with the company and the [general] stockholders. It is a matter of corporate governance," said Kim Sang-jo, professor at Hansung University and executive director at the People’s Solidarity for Participatory Democracy. "The board of directors is obliged to explain how the interest of the company and stockholders is realized via issuance of new shares or dispute over management control, but the board is neglecting its duty."