|

|

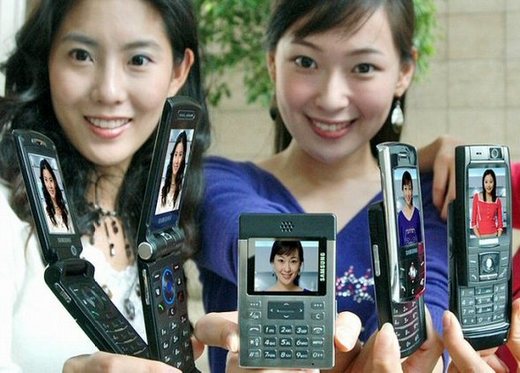

Five types of handsets recently offered by Samsung Electronics.

|

S.K. economy dependent upon cell phone exports

The mobile handset industry, one of main forces behind the nation’s export-driven economy, is showing signs of losing its momentum, as many local handset makers are facing an unprecedented crisis due to squeezed market shares and lower profit margins. Last week, VK Corp. declared bankruptcy, another example of how local mobile handset makers are grappling with a two-pronged challenge: price competition from global companies and a stronger local currency that is raising prices for Korean goods overseas. While Finland’s Nokia Corp. unveils low-priced mobile phones for a wider range of customers and U.S.’s Motorola Inc. leads the world with its ultra-slim phone models, local handset makers have failed to respond to fast-changing market conditions. The South Korean won’s appreciation against the U.S. dollar has compounded the problem, making sales sluggish in overseas markets."As global competitors have played a strong game of catch-up in those areas where South Korean companies previously held the upper hand, such as uniqueness of design and diversity of models, the weaknesses of local firms have become more conspicuous," said Roh Geun-chang, an analyst at Korea Investment & Securities Co. Such unfavorable conditions are translating into a deterioration in earnings by local mobile handset makers. As of the end of May, exports of handsets stood at 6.88 billion USD, down 9.9 percent from the same period last year. The operating profit rate for the handset business of Samsung Electronics Co. tumbled to 10 percent in the first quarter of this year from the 20 percent recorded during its heyday. LG Electronics Inc. also posted 30.9 billion won (31 million USD) in operating losses during the January-March period this year. Samsung Electronics, the world’s No. 3 mobile handset maker, saw its gap with second-ranked Motorola widened from 2.5 percent in the first quarter of last year to 7.4 percent in the first quarter of this year. Additionally, No. 5 mobile phone manufacturer Sony Ericsson Mobile Communications Ltd. has narrowed its gap with South Korea’s LG Electronics, the No. 4 maker. Under these circumstances, Samsung Electronics is still sticking to its business stance of focusing on the premium market. The problem is that it has come up with no "killer model" to appeal to high-end customers since it had a hit with its Blue-Black model. Samsung is pinning its hopes on the super-slim "Ultra Edition" phone, priced at more than 400 USD. LG Electronics is also focusing its efforts on the sale of a premium model, its Chocolate Phone, in order to make a comeback in the market. Rumors are circulating that its mobile phone business will soon be up for acquisition in a merger. Pantech is also struggling not to lag behind within ever-worsening market conditions. "Chances are slim that things will turn around in the short term," a Pantech official said. "We will focus our business capacity selectively on the areas where there is potential for a major overhaul."