Founded in 1972, Kim & Chang is the largest law firm in South Korea, employing as many as some 1500 employees including 321 lawyers, with 66 of them holding accreditation from abroad. Recently, there has been a weekly protest staged in front of Kim & Chang's headquarters in Seoul, calling for a search warrant for its past involvement in the sell-out of the Korea Exchange Bank to the U.S. fund Lone Star at a price much lower than market rates at the time. Why has a firm that specializes in offering legal counseling become the subject of such financially-linked allegations?

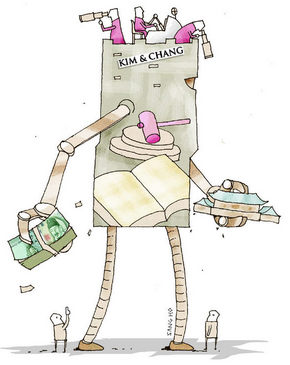

Kim & Chang is very well known in Korea for its power and influence as well as its ability to collect information, so much so that it is even dubbed by some as an "unbridled power magnet." The Hankyoreh will run a two-part story about Kim & Chang's powerful influence and its less well-known dark side.

In July 1997, just before South Korea suffered the brunt of the Asian financial crisis, Hyundai Electronics Co. reported to the Ministry of Finance and Economy (MOFE) that it would sell 30 percent of its stock share that it had in the Kookmin Trust to the Canadian Imperial Bank of Commerce (CIBC). But MOFE determined the sale would amount to an unlawful cash loan deal, after confessions from a Hyundai official and the lawyer working on behalf of the Canadian bank saying that the two sides had colluded to sign a "side letter," a secret deal in which Hyundai would later buy back the stocks at a higher price.

Later, Hyundai and its legal representative, Kim & Chang, submitted a "statement of confirmation" to MOFE in which they pledged that they "did not and would not sign such a side deal." Subsequently, MOFE approved the deal. However, in March 2000, the fact of the side letter's existence came to light when CIBC started to exercise appraisal rights of dissenting shareholders based on the terms set forth by the side letter. Kim & Chang continued to vehemently claim that it did not know about the presence of the side letter.

Yet the bill Kim & Chang sent to Hyundai for its legal services shows how deep the law firm had been involved in all of the deal process. According to the bill, the law firm performed such tasks as reviewing the fax that Hyundai had sent regarding loan credit for transaction. The bill also shows that Kim & Chang wrote and revised the draft of the rights of shareholders to request the purchase of the shares. According to the bill, Kim & Chang also contacted the Canadian bank and Hyundai before it finally submitted the draft to MOFE.

The incident highlights the powerful dark side of Kim & Chang. It helped big businesses to earn loans illegally, which is considered one of the main culprits of Korea's financial crisis. It also made dishonest statements to the government in order to appease them, and now is still denying any illegal acts.

In regards to the ongoing investigation by the Prosecutor's Office into the suspicious sellout of Korea Exchange Bank at rock-bottom prices, Kim & Chang insisted that the managing underwriter for the sellout, Morgan Stanley, and the American law firm that advised Lone Star did most of the job. Kim & Chang called its involvement minimal.

But if so, why are some people pointing their fingers at ex-Finance Minister Lee Heon-jae and Kim & Chang - where Lee had previously served as advisor - as the actual movers and shakers of the deal?

"Kim & Chang not only provides legal service, but also uses its clout to check with the government for its view on certain issues," says a former official who worked for the Financial Supervisory Commission. "If the relevant department makes a different interpretation of the issue, [the firm] overturns the decision by using its influence on the high offices of the government. Kim & Chang has more political influence than any other law firm I know."

A former head of a foreign company in Korea said, "In our work, there are sometimes problems that laws cannot solve easily. Kim & Chang is the best in interpreting the law to our benefit and solving the issue by using its political influence. For a company considering entry into Korea, Kim & Chang is the best place to start."

Kim & Chang's influence does not stop at providing "express passage" that smoothes out communication between clients and high-ranking officials in the government. It is also said that the powerful law firm was behind some recent governmental legal revisions that stipulate various permits and regulations. The recent finance-related law revisions Kim & Chang is said to be "deeply involved" in include modifications of the Securities Trading Law, the Asset-Backed Securitization law, and the Indirect Investment Asset Management Law.

The presidential office has taken notice of the situation. When the current government took power in early 2003, key presidential secretaries, including ones in charge of audit and legal affairs, held several rounds of discussions regarding streamlining the legal service market in Korea. One of their concerns was big legal firms' hiring ex-top government officials as advisors.

The committee discussions were attended by officials from the National Tax Service, the Public Prosecutor's Office, and the Fair Trade Commission, and were presided over by the presidential audit secretary. The committee ordered the National Tax Service (NTS) to investigate the income profiles of big law firms' advisors. The goal was to find out what kind of roles they played in legal cases in which they received incentive bonuses for their contribution, in addition to their basic salary. But NTS didn't disclose the income data uncovered, and in time the matter fizzled out. The NTS investigation official that participated in the initial meetings in fact now serves as advisor for Kim & Chang.

"When I talk with other law firms, they often say 'this case is legally difficult.' But when I talk with Kim & Chang, they say, 'Let's see what can be done,' " said a businessman who has used different law firms' services. Behind Kim & Chang's confidence lies its 'best and brightest' team of lawyers specializing in different fields, but it also has to do with its team of high-profile advisors who come from backgrounds in the government.

Today, most South Korean law firms employ advisors. Even the law firm Lee & Ko, which used to not hire advisors for fear of public criticism that the advisors were actually lobbyists, changed its mind. From last year, it hired advisors comprising of ex-high ranking officials from the Fair Trade Commission and the Financial Supervisory Commission. Without advisors, it is hard to stay competitive in the Korean legal service market.

Kim & Chang has been at the forefront of this trend. Starting from recruiting Hyun Hong-choo, a former ambassador to the United States, in the late 1980s, it now has more advisors than any other law firm in Korea.

When asked, Kim & Chang told The Hankyoreh that it had 14 advisors working for its firm. But when The Hankyoreh looked through Kim & Chang's web search pages that are only accessible by employees, there were actually 44 individuals who had held senior government posts.

Among the 44, those from the National Tax Service numbered the most at 22, followed by six from MOFE, four from the Ministry of Commerce, three from the Ministry of Labor, two from the Financial Supervisory Commission, and one each from the Ministry of Foreign Affairs, the Fair Trade Commission, the Office for Government Policy Coordination, the Ministry of Health & Welfare, the Board of Audit and Inspection of Korea, the Bank of Korea, and the Ministry of Defense.

As for these advisors' contributions, Kim & Chang explains: "We often have to cover many technical areas in which our tax counselors and legal experts are not specialized. You know this happens in government organs as well. For example, the Prosecutor's Office is assisted by specialists sent by the NTS or the Financial Supervisory Commission."

This explanation, however, is an inadequate defense, as the firm employs not just top-level advisors, but also mid-level current government officials from NTS and FSC, by giving them titles such as "section chief" or "vice-section chief." To this, Kim & Chang said: "It's because the nature of each individual's work is totally different based on their posts. So, we have to give them different titles. We're hiring these mid-level individuals for the purpose of training them, just like we train new recruits for our legal team."

But this explanation is still less than convincing. Why would the firm hire mid-level officers who have current posts at the government and even bother to train them for later use, when the law firm already has an army of highly experienced advisors? Kim & Chang has even hired 4 current investigators from the Seoul High Public Prosecutor's Office and investigators from the Seoul Prosecutor's Office Special Affairs Department.

Kim & Chang isn't short of explanation, this time saying: "We have hired them to have them run some errands, just like some prosecutor-turned lawyers employ current investigators to take care of their administrative matters.

To this, a prosecutor-turned-lawyer disagrees: "I think they are hiring these incumbent legal officers to obtain some important information, including various insider information."

An ex-official with the FSC said, "Those in Kim & Chang who are from the FSC once in a while invite their former FSC subordinates to have a good dinner and fine wine. They even offer advice to them, saying, for example, 'When I was in your position, I did it this way.' " In other words, Kim & Chang works as an avenue for both communication and lobbying between its clients and the people in the government who can wield influence. It is illegal for someone who is not a lawyer to act on behalf of legal cases. But Kim & Chang maintains that "since these people merely 'assist' lawyers, there is nothing problematic."

A head of a government body, asking not to be named, said, "From what I see, Kim & Chang's power comes less from its money and more from its hint of offering a possible post with the powerful law firm. Let's say an ex-cabinet minister of Kim & Chang shows up in a company-provided luxury car with a driver and says to an incumbent government official: 'Let's play golf some time.' To bluntly put it, he is giving a hint to the official: 'Look! You can also join Kim & Chang at some point, just like I did.' And he cannot decline when the law firm's advisor approaches asking for some favors."

Kim & Chang's advisors also have access to exclusive information in the government and financial sectors by working as members of the Board of Trustees at these organizations, or by participating in various committees under the government.

A graver problem is the fact that these former top government officials who are now working as advisors for Kim & Chang are sometimes appointed back to governmental posts and even shuttle back and forth between the government and the law firm. For example, Lee Hun-jae who worked as chief of the FSC during the Kim Dae-jung administration, later served as advisor to Kim & Chang, and then was appointed Minister of Finance during the current administration. After his retirement from that post, he returned to Kim & Chang.

His successor, Han Duck-soo, was also with Kim & Chang before his appointment. Additionally, Jeon Hong-ryeol, an ex-section chief of the finance ministry, started to serve as a Kim & Chang advisor in 1997 and last year was appointed vice director-general of FSC. Former prosecutor Park Jeong-gyu started work for Kim & Chang in 2000, and later served as presidential secretary for civil affairs, only to return to the law firm last year.

Given this situation, for those who work in the government, it is quite possible that someone who currently serves as Kim & Chang's advisor may become his or her boss. So, it is understandable for them to become quite conscious in their dealings with Kim & Chang members in their work.

The salary of Kim & Chang's advisors is also a subject of controversy. Even though they work for the law firm, they are not themselves lawyers, and it is illegal for someone who is not a lawyer to receive additional money for working on a case. Kim & Chang claims that it has never paid its advisors incentive payments other than their basic salary.

However, a former high-ranking official of the NTS said that he looked into Kim & Chang's advisors, and found that their income structure varied widely, with an annual 200 to 300 million won as base, and additional incentives provided based on their performance.