|

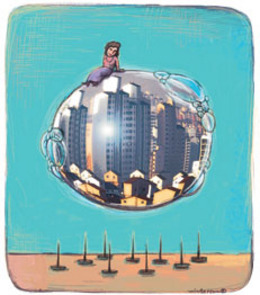

Housing bubble, household debt could bring economic house

Experts are issuing warnings that the South Korean economy may be in danger due to a bubble effect seen in apartment prices in Seoul and its neighboring areas, along with mounting household debt. The effects of these factors could deal a serious blow to the overall economy in the long term, economists said. On December 17, the LG Economic Research Institute said in a report that the most notable signs of crisis in the South Korean economy are a perceived bubble in apartment prices together with snowballing household debt. The 1997-98 Asian financial crisis was caused by a short-term liquidity problem among large firms, or chaebol, and their affiliates. Now, the same type of crisis is seen as looming among households, the report said. Since 2002, in fact, household debt has been mounting, as home prices have surged in Seoul and its neighboring areas. Apartment prices jumped 3.5 times to 15.46 million won (US$16,000) per pyeong (3.3 square meters) in 2006, compared with 4.39 million won per pyeong in 2002. As of the end of September, household debt stood at 559 trillion won nationally, equivalent to 11 million won per man, woman, and child in South Korea. Total household debt rose by 46 trillion won in 2005 and by 38 trillion won in the first nine months of this year. Of the components of household debt, home-backed loans stand at 215 trillion won. LG Economic Research Institute researcher Song Tae-jeong said, “If the looming crisis becomes a reality after the property bubble bursts and we see ensuing capital flight, weak investment and low consumption will continue. A chronic economic downturn will weaken the economy’s overseas competitiveness and the nation’s external credit rating.”The Korea Institute of Finance issued a similar report. Gang Jong-man, senior researcher at the institute, said the possibility of a financial crisis stemming from a surge in home-backed loans is emerging, despite the government’s plans to stabilize the housing market. If the property bubble bursts and interest rates rise, households may not repay their debt in time. In addition, if the economy slows sharply, it will cause a financial crisis, the report said. To counter the looming economic crisis, experts urge the government to cut household debt by stabilizing housing prices. “In the future, the crisis may be in the form of a chronic status, not a one-time [event],” LG Economic Research Institute researcher Lee Cheol-yong said. “First of all, the top priority is to guide money into the manufactoring sector and away from property assets. While these measures cause strong resistance from asset holders, only small yet strong government can resolve this problem," Lee added. Please direct questions or comments to [englishhani@hani.co.kr]