Posted on : Jan.8,2018 17:02 KST

Modified on : Jan.9,2018 17:55 KST

|

|

Yoo Myung-hee, trade policy bureau director-general at MOTIE, leads the South Korean delegation discussing amendments to the KORUS FTA with the American side led by Assistant US Trade Representative Michael Beeman at the conference room of the US Trade Representative’s office in Washington, D.C. on Jan. 5. (provided by MOTIE)

|

US side pushing for place-of-origin changes in automobile and steel industries

“It does seem to be the case [from the first meeting] that these won’t be easy negotiations. It’s going to be a tense contest over how to go about resolving the sensitive issues we saw today.”

This was the message shared with South Korean foreign correspondents by Yoo Myung-hee, trade policy bureau director for the Office of the Minister for Trade and senior South Korean delegation representative for negotiations to amend the South Korea-US Free Trade Agreement (KORUS FTA), after the first round of negotiations in Washington concluded Jan 5.

Neither side was reported to have thrown any curveballs during the first meeting. When asked whether the two sides had both shown their cards, Yoo replied, “There could be more things that appear going ahead, but there was a sufficient exchange of opinions on the areas where the two sides are going to focus their interest for now.”

“It was effective in terms of getting a read of each side’s detailed position,” she added.

|

|

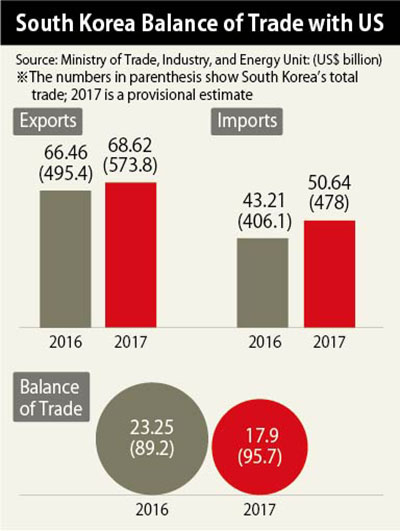

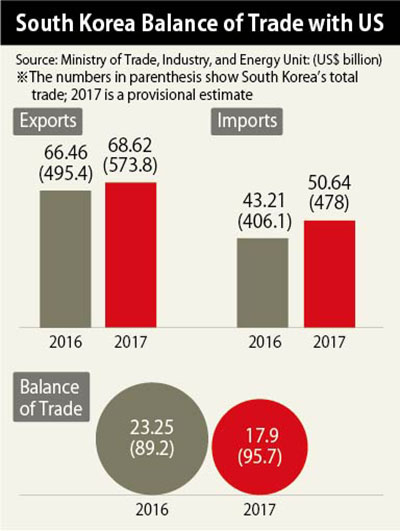

South Korea Balance of Trade with US

|

While neither side offered specifics, accounts from short briefings after the talks suggested the negotiations are more likely to focus on practical wins in specific areas such as automobiles and steel than on existing agreement provisions or adjustments in the schedule for abolition or reduction of tariffs according to the current schedule. While the talks are superficially aimed at an “amendment,” they appear poised to turn into a battle over items that have already emerged as trade issues between the two sides.

With the talks aimed at relieving “trade imbalances,” the US focused in the first meeting on the areas of automobiles and automobile parts, sources said. Automobiles represent South Korea’s top-ranked category in terms of US exports, accounting for US$24 billion of South Korea’s surplus of $27.7 billion (according to US statistics) with the US in 2016 for all products. After the talks, the Office of the US Trade Representative said the two sides “discussed proposals to move towards fair and reciprocal trade in key industrial goods sectors, such as autos and auto parts, as well as to resolve additional cross-cutting and sector-specific barriers impacting U.S. exports.”

Automobiles and automobile parts are already duty-free areas. Sources reported that the US focused its demands on the abolition of “non-tariff barriers” to imports of US automobiles, including safety regulations by South Korean authorities and environmental regulations on emissions. The current FTA sets quotas allows imports of up to 25,000 vehicles per business even when the automobiles do not meet South Korean safety standards as long as they meet the US’s. The use hopes to eliminate or raise the quota.

In terms of place-of-origin regulations subject to preferential tariffs, the US reported made the sensitive demand to procure parts from a specific country – namely the US – for use at Hyundai-Kia’s factories in Ulsan and in the US. It also proposed tougher place-of-origin standards on steel items, ostensibly to prevent cheap Chinese steel from being exported indirectly to the US through South Korea.

Analysts said the US’s focus on specific items and “implementation” of the current FTA rather than amendment of its terms suggests a conclusion that its best strategy is to achieve reductions in trade imbalances.

“The increase in the US’s trade deficit is less about the FTA per se than differences in the two countries’ microeconomic and macroeconomic environments, including their economic growth rates and industry structures,” said one South Korean trade official. Indeed, the US appears to view it as more beneficial to tweak place-of-origin regulations and non-tariff barriers in the large-deficit items of automobiles and steel than to alter the current phased tariff abolition or reduction schedule.

The fact that South Korea’s trade surplus with the US dropped sharply from US$23.2 billion in 2016 to US$17.9 billion last year without any changes to the amendment was cited as a factor in the US’s adoption of a strategy focused on practical gains in specific areas.

With US President Donald Trump adhering to an “America first” position, South Korean trade authorities have accepted a reduction in the trade surplus with the US as inevitable during his term, and are focusing more on addressing trade issues such as US import regulations affecting South Korean steel, washing machines, and solar panels. The Office of the Minister for Trade announced shortly after the first round of negotiations that the South Korean side has “raised the investor-state dispute system and trade remedies as areas of interest.”

By Cho Kye-won, staff reporter

Please direct questions or comments to [english@hani.co.kr]