The move dramatically reverses the position the company stated less than one year ago

Samsung Electronics’ surprise announcement of plans for a 50-to-1 stock split is raising questions over the factors behind the company’s decision. With its move, the company reversed the position it stated in Mar. 2017, when it said a split would “not help to enhance shareholder value.” Analysts offered various interpretations on its change in stance, which comes five days ahead of sentencing in the second trial of vice chairman Lee Jae-yong.

“The board of directors voted to proceed with a 50-to-1 stock split as a measure to enhance shareholder value,” Samsung Electronics said in announcing its split plan on the morning of Jan. 31. Its aim is to promote an increase in share values as the split lowers the barriers to purchasing and increases sale activities.

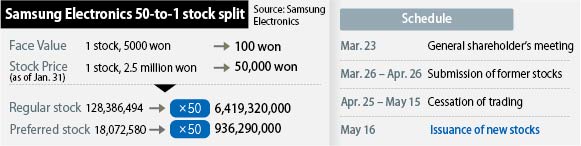

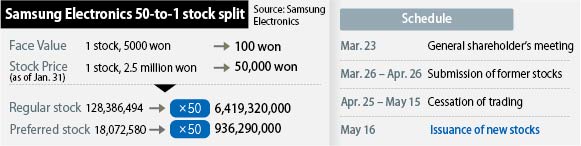

The split increases the total number of Samsung Electronics shares from 128,380,000 to 6,419,320,000, with a single 2.5 million won (US$2,340) share converted to fifty 50,000 won (US$46.80) shares. If the decision is approved at an upcoming general shareholders’ meeting on Mar. 23, Samsung Electronics is to list the new shares as of May 16 following exchange procedures for the old shares.

|

|

Samsung Electronics 50-to-1 stock split

|

After passing the 1 million won (US$935) mark in 2011, the value of Samsung Electronics shares rose to 2 million won (US$1,870) as of Jan. 2017 and is currently in the range of 2.4 million to 2.6 million won (US$2,240–2,430). Without a stock split, the large amount has put shares relatively out of reach to ordinary investors. Individual domestic investors accounted for just 3% of all Samsung Electronics shareholders as of the third quarter of 2017, with the vast majority of shares held by foreign investors (53%), the Samsung Lee family (20%), and domestic institutions (17%). Once the share price drops to the 50,000 won range, individual investors will be able to purchase them more easily.

“A stock split has no impact on the company’s fundamentals, but share values could increase somewhat as transaction volumes grow,” said HI Investment & Securities analyst Lee Sang-hun.

In the past, Samsung Electronics waved off calls for a stock split. At a general shareholders’ meeting in Mar. 2017, vice chairman Kwon Oh-hyun said a stock split was “not under consideration.” Committing on the change in stance ten months later, experts said the timing of the decision should be noted.

“This gives the appearance of a performance staged ahead of Lee Jae-yong’s second trial,” said a securities company analyst who asked not to be identified.

“It looks like they’re trying to promote a favorable image with the court and the general public by turning ‘imperial shares’ into ‘people’s shares,’” the analyst commented.

Some observers saw the measure as intended to reverse a recent decline in share values and deflect blame for Lee Jae-yong tarnishing the company’s image, while also avoiding scrutiny from the National Pension Service and other institutional investors.

“Ever since Lee Jae-yong’s incarceration, Samsung Electronics has spent a huge amount of money toward boosting shareholder value with dividends and purchasing or retirement of treasury stock in order to appease investors,” another securities company analyst said.

Samsung looking to deflect blame from Lee Jae-yong conviction

“The stock split looks to be the epitome of that, where they’re trying to increase share values to deflect blame directed at Lee Jae-yong,” the analyst said, suggesting the measure may be meant to avoid calls for Lee’s resignation as registered director during the Mar. 23 shareholders’ meeting.

The move is also being interpreted as a response to the increased exercise of voting rights by institutional investments under the Moon Jae-in administration, as with the introduction of “stewardship codes.”

“It looks like one of the aims is to increase the number of individual investors to head off the increased clout of the National Pension Service (NPS), which is the single largest shareholder [at 9.7%] and has been increasingly exercising voting rights under the new administration,” the analyst said. An anticipated effect of increasing the proportion of individual investors from its current 3% would be to fend off increased management involvement by institutional investors like the NPS.

Uncertainty as to whether the stock split will increase share values

But with a stock split representing a qualitatively different approach from treasury stock purchasing or retirement and increased dividends to return profits to shareholders, it remains to be seen how well the move will work to increase share values – especially when the intrinsic corporation value itself does not change. An analysis of stock splits since 2000 by KB Securities showed a rise [in share value] after the initial announcement, followed by a decline after a certain amount of time.

While the value of Samsung Electronics shares rose above 2.7 million won (US$2,520) the same day – spiking by 8.71% at one point in the morning – the increase declined over time, and the shares finished the day up 0.2% at 2,495,000 won (US$2,333). Foreign investors, who own 52.45% of shares in Samsung Electronics, sold off 615.5 billion won (US$575.6 million) the same day – the largest amount in four years and eight months.

Meanwhile, Samsung Electronics announced the same day that it had recorded historic highs of 53.65 trillion won (US$50.2 billion) in operating profits and 239.58 trillion won (US$224.0 billion) in sales last year. Operating profits for its semiconductors alone were up 258% from the year before to 35 trillion won (US$32.7 billion), while operating profits for the home appliance sector totaled 1.65 trillion won (US$1.54 billion), down 1.06 trillion won (US$991 million) from 2016.

By Choi Hyun-june and Han Gwang-deok, staff reporters

Please direct questions or comments to [english@hani.co.kr]