|

|

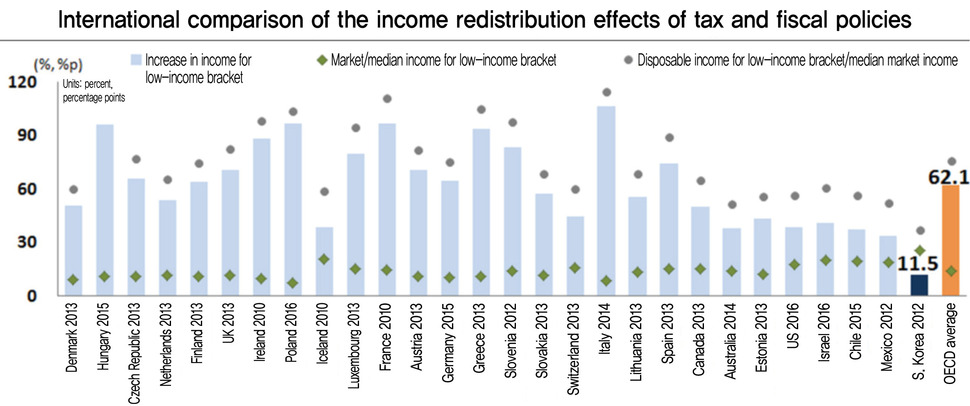

International comparison of the income redistribution effects of tax and fiscal policies

|

HRI study reveals poverty exit rate far below average among member nations

South Korea ranks in the lowest category among 28 OECD member countries for the income redistribution effects its tax and fiscal policies has had, a report shows. A report titled “International Comparison of the Income Redistribution Effects of Tax and Fiscal Policies” published by the Hyundai Research Institute (HRI) on Nov. 11 showed 80.5% of South Korea’s low-income population to have remained in that category despite government tax and fiscal policies, with just 19.5% managing to exit poverty. The poverty exit rate refers to the percentage of low-income bracket members (those earning less than 50% the income-standardized equalized median income according to household members) who advance to the middle- or upper-income brackets (according to disposable income) after the implementation of government policy measures such as subsidies and pension insurance payments (based on market income). In contrast, the average poverty exit rate for the 28 OECD member countries examined, including the US, France, and the UK, stood at 64.1%. (Eight of the OECD’s 36 countries were not examined, including Japan and Turkey.) The numbers were calculated by HRI using data from the Luxembourg Income Study (LIS, representing a given point between 2010 and 2016 for OECD member countries). The South Korean data came from 2012; an additional analysis using Statistics Korea household trend data from 2016 (not including farming and fishing households) showed a poverty exit rate of 24.7% – far below the OECD average. The income improvement effect for low-income bracket members through tax and fiscal policy was calculated at 11.5 percentage points for South Korea, far below the OECD average of 62.1 percentage points. Average market income for low-income bracket members stood at 13.7% of the median income for all member countries, but disposable income increased to 75.8% of the median after redistribution, giving an income improvement effect of 62.1 percentage points. At 470,000 won (US$415) a month, the market income for South Korean low-income bracket members stood at 25.3% of the median value of 1.84 million won (US$1,630), which was higher than the OECD average, but increased to just 36.1% of the median income at 680,000 won (US$601) a month after redistribution. HRI attributed the limited income redistribution effects in South Korea as the result of social and welfare spending (10.4% of GDP in 2016) amounting to less than half the OECD average (21.1%). Another factor cited was the low income replacement rate for the public pension – seen as a gauge for post-retirement income security – at 39.3%, compared to a 58.7% average for OECD members. “Strengthening the income redistribution function of tax and fiscal policy will require a societal consensus on the individual social burden and welfare,” HRI concluded. By Cho Kye-wan, staff reporter Please direct comments or questions to [english@hani.co.kr]