|

|

Trends in trading of carbon emission credits in South Korea

|

Holders excessively rolling over credits from year to year driving up prices

|

|

Trends in trading of carbon emission credits in South Korea

|

South Korea’s carbon emission credit trading system has yet to establish itself firmly as it enters its fourth year since being introduced to reduce greenhouse gases. A persistent practice of holders excessively “rolling over” surplus emission credits from year to year rather than placing them on the market has resulted in carbon trading prices skyrocketing, leading companies that lack sufficient credits to complain of huge purchasing costs. Observers also noted that the failure of the market’s function to operate is lowering the likelihood of achieving the aim of effectively reducing total greenhouse gas emissions in South Korea.

In late October, the South Korean government notified a total of 591 businesses of their allowable carbon emissions for the greenhouse gas emission credit trading system’s second planning period of 2018–2020. Most of the allocations were still provided free of charge – but as of next year, 126 companies will need to pay for 3% of their total allotment from the government under an auction format. The notifications mean the second implementation phase for the emission credit trading system – first introduced in Jan. 2015 – has now begun in earnest.

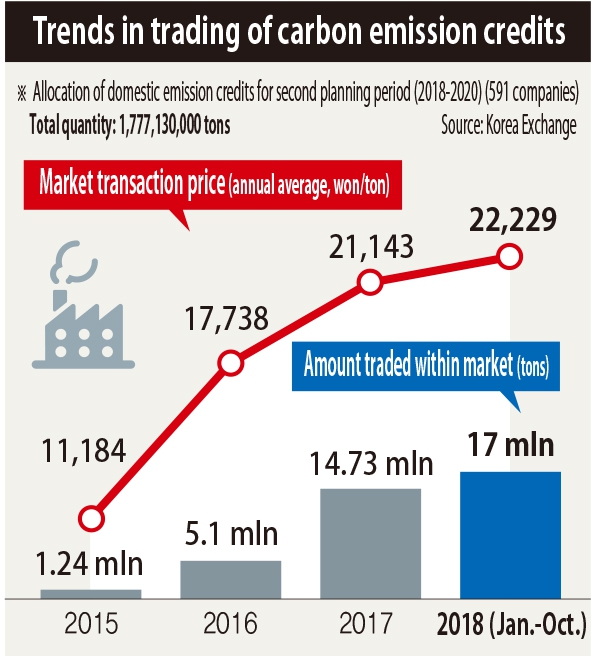

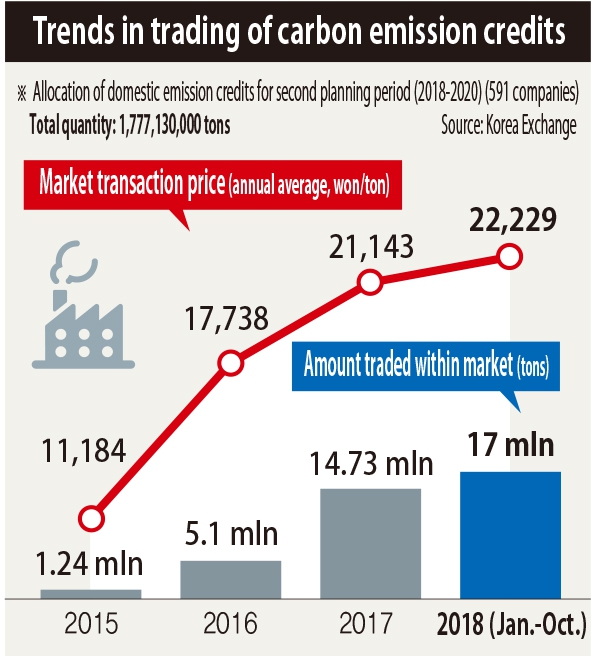

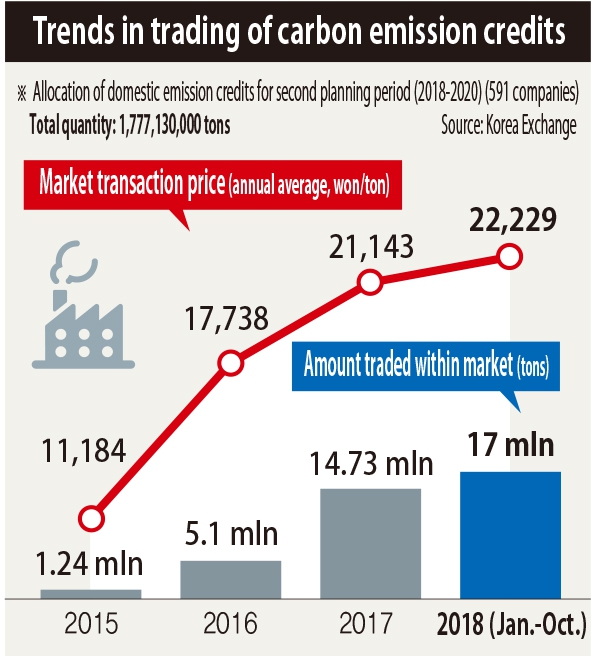

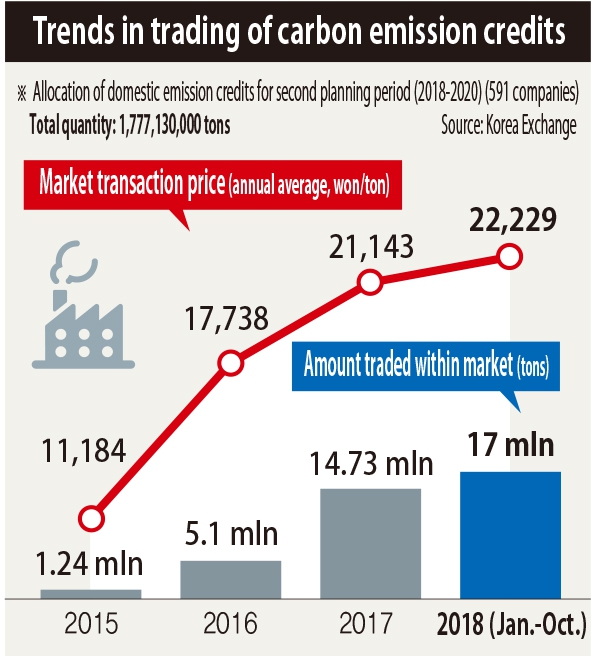

Total domestic emission credits allocated for the second planning period (three years) amount to 1,777,130,000 tons. In a recently published report on emission credit trading trends, the Korea Exchange (KRX) observed, “The South Korean emission credit trading market is a textbook case of a seller-dominated market with an inadequate supply of surplus emissions credits left over [due to additional emission reduction activities and reduced factory operation rates] relative to the demand for emission rights.”

“The lack of transaction activity and shortage of liquidity has caused a failure to properly perform the market’s function of relieving the financial burden of reducing greenhouse gas emissions for companies through the trading of emission credits,” the report said.

Persistent practice of companies excessively rolling over surplus credits to next year

While part of the reason for the lack of credits for sale on the market stems from the small amount of surplus credits left over from year to year, another factor is the persistent practice of companies excessively rolling their surplus credits over to the next year rather than putting them up for sale.

“In 2017, around 20 million tons of total surplus volumes were rolled over to this year,” reported the Korea Environment Corporation, which receives reports from companies every June on their efforts to honor their reduction obligations. Between 2015 and Oct. 2018, a total of 38.09 million tons in carbon emissions credits were traded on KRX. This means surplus volumes since 2015 roughly total 118 million tons, including 80 million tons rolled over and around 38 tons traded on the market.

As of October, market trading prices for emissions credits in 2018 averaged 22,229 won (US$19.74) per ton. The amount has been increasingly steadily from its 2015 annual average of 11,184 won (US$9.93).

“The five coal-fired power plant companies account for around 90% of all trading volumes, with most of the market trading involving around 30 companies including Samsung Electronics and steel companies,” explained a KRX official.

“But a lot of the transactions in the 100-ton range take place outside of the market rather than according to market transaction prices, with partners seeking each other out individually in cooperative transactions,” the official added.

Cooperative transactions are typically based on market trading prices (three-month weighted averages), but are not disclosed.

“The burden over the past year has been large, as we’ve had to purchase 400,000 tons to make up for the carbon emission credit shortfall, at a cost of over 70 billion won (US$62 million),” Hyundai Steel said.

“Innovations in international reduction equipment technology have also been slow to emerge, which means we can only currently achieve reductions of about 1 to 2% from one year to the next, so it’s difficult to resolve the issue through reduction equipment investment,” the company added.

Lack of liquidity results in withdrawal of small volumes, causing prices to jump

As June approaches and companies have to report on their efforts to meet their obligations, companies are forced to work harder to make up for the shortfall, which has led to a repeated cycle of the government freeing up reserves (4.66 million tons last June) into the market to make up for the shortage of credits available for sales. Because of the lack of liquidity, it has become common for the withdrawal of even small volumes of around 10 tons for sale to cause trading prices to jump to the 28,000 won (US$24.86) range.

Companies that have surplus credits are motivated to hold on to them to protect against different risks, including fluctuations in market trading prices, future business environment prospects, and uncertainties surrounding the administration’s carbon emission policies. This risk-averse tendency has resulted in a marked trend of companies opting to roll over their credits. The Ministry of Environment has taken steps to restrict the rollovers by assigning more credits the following year to companies that put more surplus rights up for sale on the market. But it remains to be seen whether market functions can operate enough to a suitable “equilibrium price” on carbon to become established.

“Because free allocations are distributed according to a company’s past average annual emissions, the effect in terms of inducing them to invest in equipment to reduce carbon emissions is undercut,” the KRX report observed.

“The current structure is one where a company that invests in low-emission equipment to reduce its emissions receives that much smaller an amount [of credits] for the next period, which results in companies putting their reduction efforts off into the future,” it said.

As an alternative approach, the report called for establishing a “market price signaling function” for overall national greenhouse gas emissions by substantially increasing trading liquidity through the allocation of more credits to companies that adopt high-efficiency, low-emission technology and the swift introduction of emission derivatives (i.e., futures, options, and swaps) with the participation of third parties and securities and financial institutions.

By Cho Kye-wan, staff reporter

Please direct comments or questions to [english@hani.co.kr]