Posted on : Jan.9,2019 16:59 KST

Both companies fell below projected figures and stock market predictions

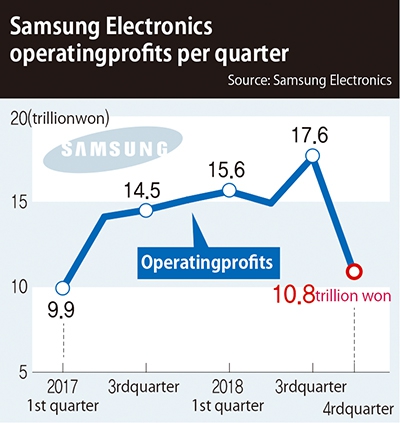

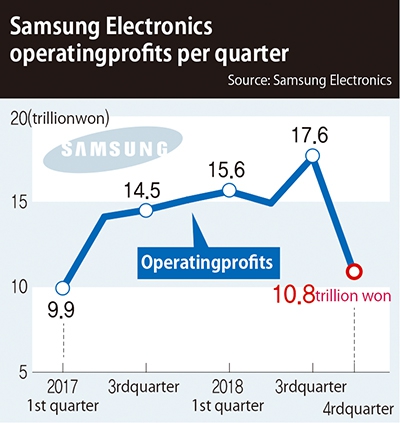

Samsung Electronics’ operating profits for the fourth quarter of 2018 (October to December) were down 30% from the year before at 10.8 trillion won (US$9.64 billion). For LG, fourth quarter operating profits stood at 75.3 billion won (US$65.58 million), a 79.5% drop from the preceding year.

Both companies suffered an earning shock with totals far below stock market predictions. Announced the same day, their current balance as of Nov. 2018 was a surplus of US$5.06 billion – the lowest in seven months. A dark shadow is looming over the macroeconomy as a whole, including investment and exports, as performance tails off for the semiconductor industry that accounts for 20% of all exports.

|

|

Samsung Electronics operating profits per quarter

|

On Jan. 8, Samsung Electronics announced projected figures for its 4Q18 performance, including 59 trillion won (US$52.63 billion) in sales and 10.8 trillion won (US$9.63 billion) in operating profits. Operating profits were down 28.7% from 15.15 trillion won (US$13.51 billion) for 4Q17 and 38.5% from their all-time high of 17.57 trillion won (US$15.67 billion) in 3Q17.

The Samsung Electronics figures were nearly 30% below what stock market analysts had been predicting. Securities companies had produced fourth quarter estimates of operating profits between 12.2 trillion and 14.3 trillion won (US$10.88-12.76 billion) for Samsung Electronics, with an average figure around 13.4 trillion won (US$11.95 billion). It marks the first time since the first quarter of 2017 that Samsung Electronics’ quarterly operating profits have fallen below 14 trillion won (US$12.48 billion).

Samsung Electronics attributed the declining performance the same day to “slowdowns in the semiconductor and smartphone areas” – considered the company’s two main drivers. The blow to operating profits was especially hard amid a slowdown in the “super boom” surrounding memory semiconductors since the second half of 2018.

Since 3Q17, Samsung Electronics had been producing operating profits of over 10 trillion won (US$8.91 billion) for semiconductors alone; in the third quarter of 2018, it registered its highest-ever operating profits at 13.7 trillion won (US$12.21 billion). Current estimates put the fourth quarter total between 7 trillion and 8 trillion won (US$6.24-7.13 billion) – a decline of nearly 40%. Smartphone sector operating profits are also projected to have fallen below 2 trillion won (US$1.78 billion) for the fourth quarter from previous quarterly totals in the 2 trillion to 3 trillion won range (US$1.78-2.67 billion). In explanatory materials, Samsung Electronics said, “Fourth quarter semiconductor memory shipments experienced reverse growth from the third quarter, and the decline in prices was larger than anticipated.”

The same day, LG Electronics announced 4Q18 sales of 15.77 trillion won (US$14.06 billion) and operating profits of 75.3 billion won (US$67.15 million). Operating profits were down 79.5% from 366.8 billion won (US$327.05 million) for the fourth quarter of 2017. The numbers were far below stock market analysts’ average prediction of 39.81 billion won (US$35.5 million). The steep decline in LG Electronics’ profitability is reportedly being attributed mainly to its MC project sector, which is in charge of smartphones.

The declining performance for semiconductors, smartphones, and other mainstay export items was confirmed in figures on the Nov. 2018 international trade balance released by the Bank of Korea (BOK) the same day. As of Nov. 2018, the current account surplus stood at US$5.06 billion, down 31.9% from US$7.43 billion for the same month in 2017. The number was the lowest in the seven months since Apr. 2017. Total exports for Dec. 2018 (as compiled by the Ministry of Trade, Industry and Energy) were down 1.2% from the year before. Analysts attributed the decline to the weakening boom in semiconductors, which account for around 20% of South Korean exports.

“In addition to slowdowns for unit prices of semiconductors, petroleum products, and other mainstay items, global trade values have declined, and a baseline effect has also resulted from the previous large increase,” BOK said.

The weakening semiconductor performance is expected to continue through the first half of 2019. Samsung Electronics and Hynix both predicted “positive performance trends” amid improving business conditions for memory in the second half of the year, but South Korean and overseas experts suggested an improvement in performance for the second half of 2019 “cannot be counted on.”

By Choi Hyun-june, staff reporter

Please direct comments or questions to [english@hani.co.kr]