|

|

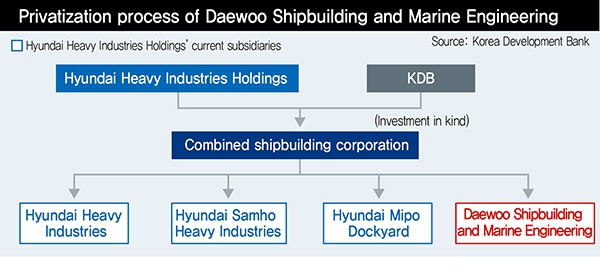

Privatization process of Daewoo Shipbuilding and Marine Engineering

|

KDB to invest in kind in new company with Hyundai Heavy Industries as largest stockholder

Work is underway on privatizing Daewoo Shipbuilding and Marine Engineering, which received trillions of won in public funds to normalize business operations after an episode of fraudulent accounting. According to this plan, the Korea Development Bank (KDB), which is the primary lending bank and the single largest stockholder in Daewoo Shipbuilding, would make a contribution in kind consisting of its entire 55.7% share in the company (worth 2.12 trillion won, or US$1.9 billion) to the integrated shipbuilding company that will be created with Hyundai Heavy Industries Holdings as its largest stockholder. This represents a transformation of South Korea’s key shipbuilding industry from a “big three system” under Hyundai Heavy Industries, Daewoo Shipbuilding and Samsung Heavy Industries into a “big two” system, as well as an industrial restructuring policy aimed at cooling down the excessive competition for cheap projects. “A conditional memorandum of understanding has been concluded for Hyundai Heavy Industries’ acquisition of Daewoo Shipbuilding. We’re moving forward with the acquisition because of our agreement about the need for Daewoo to be restructured with Hyundai Heavy Industries, which is the core of the shipbuilding industry,” KDB Chairman Lee Dong-gull said during a press conference held on Jan. 31. “We’ve also approached Samsung Heavy Industries, the other potential buyer, about its attitudes toward acquisition. If we receive an offer from Samsung Heavy Industries, we will compare that with the terms offered by Hyundai Heavy Industries and make our final decision about the acquiring party,” Lee added. In short, Daewoo Shipbuilding will be receiving new ownership 20 years after its financial circumstances began to improve following the bankruptcy of the Daewoo Group in 1999.

|

|

World‘s top shipbuilders

|