Posted on : Mar.17,2019 18:24 KST

|

|

`

|

Sudden jump in figures reveals pressure campaign by US to reduce trade deficit

|

|

`

|

When the Hankyoreh reviewed trade statistics provided by the Korea International Trade Association (KITA) on Mar. 12, there was one category in which import value and volume had undergone record-breaking changes since November 2017. This category is No. 270900 according to South Korea’s Harmonized Tariff Schedule (HSK): petroleum and asphalt. This is Korea’s number-one import. US-pumped petroleum imported by Korea between January and October 2017 was worth a total of US$382 million. But Korea purchased US$224 million worth in November and US$119 million worth in December, or US$343 million in just two months.

On Nov. 8, 2017, US President Donald Trump had a closed-door meeting with South Korean government officials and executives from some 10 conglomerates, including SK and Hanwha, and secured a commitment for specific amounts of US energy and weapons purchases as well as their timeframe.

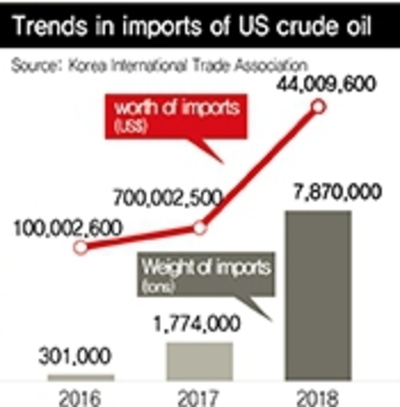

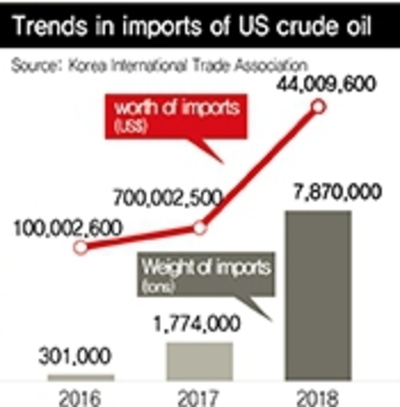

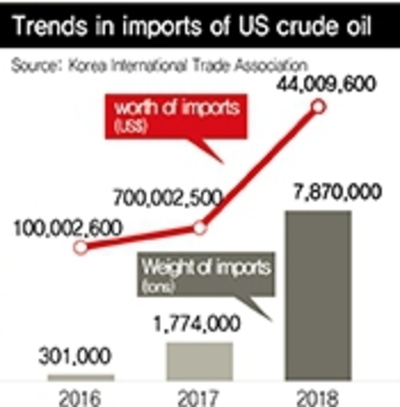

South Korea only imported US$126 million worth of US crude oil in 2016, but that shot up to US$725 million in 2017 and then ballooned to the shocking figure of US$4.5 billion in 2018. Last year’s figure was up 520% from 2017 and up 3460% from 2016. Oil imports in January 2019 were worth US$531 million. And it’s not because of some spike in the price of imported crude oil. There’s also been a spike in the volume of crude oil being imported: 301,000 tons in 2016, 1,774,000 in 2017, 7,870,000 in 2018 (2,514% higher than in 2016) and 1,120,000 tons in January 2019.

|

|

1`

|

“American oil was more competitively priced at the end of last year, with the gap between West Texas Intermediate (WTI) and Middle Eastern oil from Dubai widening from US$2-3 to US$8 a barrel. But since domestic oil refiners’ facilities are tailored for Middle Eastern oil, US crude oil is for the most part coming in on short-term contracts,” said an insider in the oil refining industry.

Although US economic sanctions on Iran that ban deals involving Iranian crude oil were reinstated in November 2018, South Korea was given an exemption. No factor other than the purchasing commitment secured by Trump — not prices, sanctions on Iran or refining facilities — is adequate to explain the 3400% jump.

Interestingly, the value of US crude oil imported in December 2018 amounted to US$993 million. That’s clear evidence of an end-of-the-year spending spree aimed at reducing South Korea’s yearly trade surplus with the US, which the US trading authorities watch carefully.

S. Korea steel already slapped with punitive quotas

South Korea’s steel industry was already slapped with punitive import quotas by Trump under Section 232 of the Trade Expansion Act. “We can’t try to sell all our products to the US anymore. We’re living in a time where pissing off the US can trigger a commercial backlash at any time. We have to tread carefully and keep a look out before we get blindsided by the US,” said a veteran of the steel industry.

South Korea’s imports from the US last year amounted to a total of US$58.87 billion, a 16.0% increase from the previous year. The import value in 2017 (US$50.75 billion) was also up 17.4% from the year before. As a consequence, South Korea’s trade surplus with the US, which had been in the US$20.5-25.8 billion range in 2013-2016, suddenly dropped to US$17.86 billion in 2017, when Trump took office, and plunged further to US$13.93 billion last year. The increase in imports of US crude oil is regarded as one of the factors in the shrinking trade surplus.

Some think that South Korea’s commitment to — and success at — narrowing the trade balance helps explain why South Korea and the US defied expectations by completing their revision of the Korea-US Free Trade Agreement in March 2017, just three months after negotiations began, without any major disputes or unpleasant requests from the US. While Trump’s ostensible request was for a revision of the agreement, his real objective, according to this view, was improving the short-term trade balance.

US disregards WTO ruling while fiercely imposing self-serving tariffs

During the past two years of the era of Trumpian trade, the existing trade order and norms of mutually beneficial free trade and shared interests based on comparative advantage and the division of labor have been shaken to their core. To take the US’ tariffs against South Korean washing machines and appliances as an example, South Korea ultimately won a complaint (in September 2016) that it filed with the World Trade Organization (WTO) about anti-dumping tariffs unfairly imposed by the US in 2013, but the Americans are still charging those tariffs and have yet to implement the WTO’s ruling.

The world is basically being realigned into a new order dominated by the logic that countries should use their power purely to enrich themselves regardless of the international order of trade, norms or legal arguments. The US attitude is that it can disregard the WTO’s ruling with impunity. That leaves South Korea with no recourse but to find a way to retaliate, while bearing in mind that it might face even worse retaliation from the other side.

“When it comes to trade, national power, which is an aggregate of the economy, technology and unity, are the source of bargaining power,” said Yoo Myung-hee, South Korea’s new trade minister, during her inaugural speech on Mar. 5. “Companies are facing new risks that they never experienced in the past because of rising protectionism and worsening trade disputes.”

By Cho Kye-wan, staff reporter

Please direct comments or questions to [english@hani.co.kr]