Posted on : Mar.17,2019 18:33 KST

CDS premium for top 4 banks lower than Goldman Sachs and HSBC

South Korea’s major banks are rated by the market as being at a lower risk of default than global counterparts such as Goldman Sachs and JPMorgan in the US and HSBC in the UK. This means that while they are far smaller in scale and profitability, they rank in the world’s top tier for soundness and safety. What makes this possible?

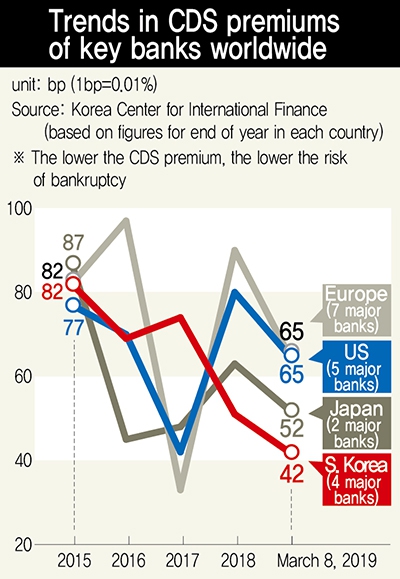

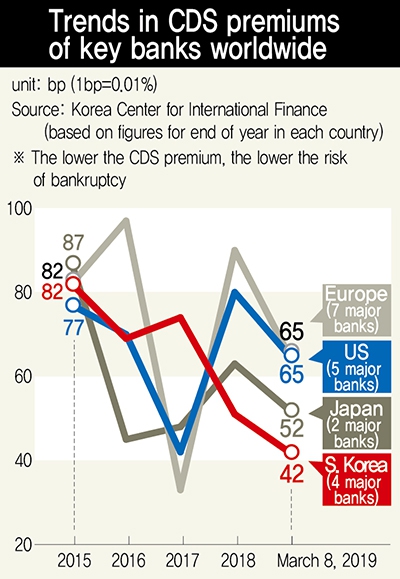

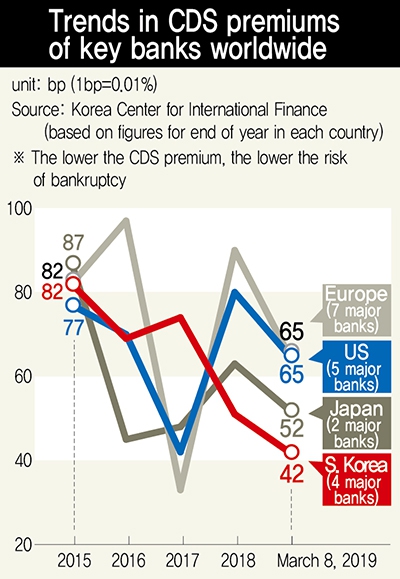

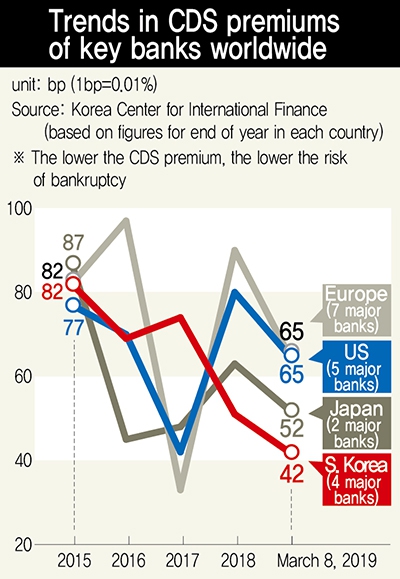

According to Korea Center for International Finance (KCIF) data released on Mar. 12, the average credit default swap (CDS) premium for South Korea’s top four commercial banks – Kookmin (KB), Shinhan, KEB Hana, and Woori – stood at 42bp (1bp=0.01%) as of Mar. 8. In contrast, the average for the top five US banks (JPMorgan, Bank of America, Wells Fargo, Citibank and Goldman Sachs) and the top seven European banks (including HSBC, BNP Paribas and Barclays) was 20bp higher at 65bp. Japan’s two major banks (including the Mitsubishi UFJ Financial Group) averaged 52bp, while the Industrial and Commercial Bank of China (ICBC) and Bank of China averaged 62bp.

The CDS premium represents a kind of surcharge paid by investors to guarantee against losses in the event that a bond-issuing institution defaults. In the case of South Korea’s top four banks, the capital preservation charge for bonds issued in the amount of 1 million won (US$879.05) totals 4,200 won (US$3.69, 0.42%), whereas larger amounts ranging from the equivalent of 5,200 to 6,500 won (US$4.57-5.71) would need to be paid for bonds issued by US, European and Japanese banks. The lower premium means the risk of incident (default) is correspondingly lower. As recently as 2015, South Korea’s top four banks had an 82bp average premium, putting them at on par with the US (77bp), Europe (82bp), and Japan (87bp); in the space of three to four years, South Korea along has succeeded in slashing the amount by roughly half.

“This is the first time in history the CDS premium for domestic banks has been this much lower than in banks in the advanced economies,” said KCIF analyst Lee Eun-jae.

“To begin with, the government (public bond) CDS premium has dropped a great deal recently. The recent substantial improvement to capital soundness at domestic banks had an influence on this state-level factor,” Lee explained.

Indeed, a Bank of Korea report the same day on trends in the international financial and foreign exchange markets since February 2018 showed an average CDS premium of 31bp as of February for government-issued dollar-denominated foreign exchange stabilization bonds (five-year) – its lowest level in more than 11 years since October 2007, when it stood at 24bp. By Mar. 8, it was even lower at 29bp. After averaging from 55 to 57bp between 2015 and 2017, the amount dropped to 39bp in December 2018 – a decline that has continued into this year.

Positive effects of diminished geopolitical risk due to improved inter-Korean relations

A default on public bonds due to insolvency refers to bankruptcy at the state level. One crucial reason for the decline of risk is the improvement in inter-Korean relations. The diminished geopolitical risk has led to a major decrease in state-level default kind, with effects that have extended to the banking world.

At the same time, it would be going too far to take these indicators as signaling an improvement or development in the state of management at South Korea’s banks. As of Mar. 8, the US Bank Index (BKX), which reflects shares in 24 major banks, had more than doubled to 97 from 47 in early 2010. In contrast, South Korea’s KRX index, reflecting shares for nine financial holding companies, fell by around 20% from 920 to 734 over the same period.

“Stock price indexes are indicators of growth potential and profitability. That’s a bit different from the CDS premium, which reflects soundness,” said Lee Eun-jae.

By Lee Soon-hyuk, staff reporter

Please direct comments or questions to [english@hani.co.kr]