Posted on : Apr.2,2019 17:02 KST

Modified on : Apr.2,2019 21:10 KST

Global semiconductor prices expected to steadily decline

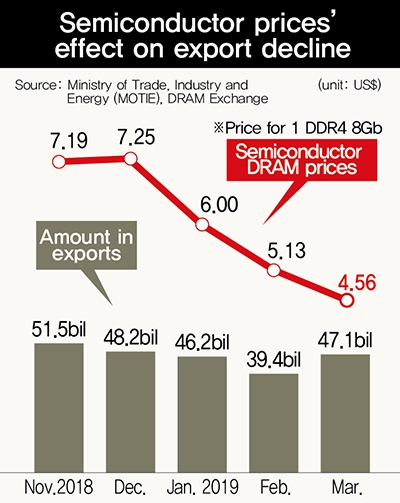

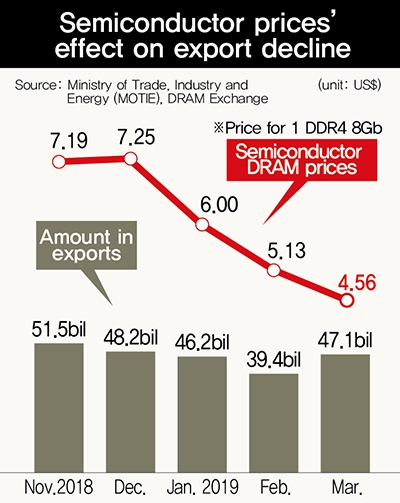

A decline in South Korean exports continued for a fourth straight month amid falling semiconductor prices. With adjustments in global semiconductor prices seen as certain to continue for some time, the slump is expected to persist for exports, which are heavily reliant on the items. But many analysts said the likelihood of the semiconductor market suffering a sudden drop or having already entered a structural recession is unlikely.

According to Ministry of Trade, Industry and Energy (MOTIE) data on export and import trends published on Apr. 1, March exports totaled US$47.11 billion, representing a decline of 8.2% from the same period last year. After experiencing a rise through November 2018, exports registered a drop in December, a decrease of 1.7% from the same period in 2017; additional drops were seen in January (6.2%) and February (11.4%) of 2019. Imports were calculated at US$41.89 billion, representing a drop of 6.7%. At US$5.22 billion for March, the trade balance was positive for an 86th straight month.

|

|

Semiconductor prices’ effect on export decline

|

Analysts attributed the four straight months of declining exports to a mixture of external risks and semiconductor market factors. With no breakthroughs yet achieved in the US-China trade conflict, economic slowdown conditions and protectionist trade approaches have been growing globally, including China’s biggest export market in China. Total days operated were down by one day from March 2018, and a baseline effect was also observed from the historic March low of US$51.31 billion in exports last year.

The South Korean government and market are paying particularly close attention to the drop-off in semiconductor exports. January semiconductor exports totaled US$7.421 billion, down 23.3% from the same month in 2018, while February exports were down 24.8% at US$6.772 billion, raising fears that the “superboom” of rising prices and demand is over. Indeed, March exports of semiconductors were also down 16.6% at US$9.06 billion – the result of declining DRAM and NAND prices amid an increase of just 1.8% in export volumes as Facebook, Amazon, Google and other global IT companies adjust their stores of DRAM memory for servers. Fixed transaction prices for DDR4 8Gb, a form of DRAM memory mainly used in personal computers, totaled US$5 for March, down 44% from the same month last year. NAND flash (128Gb) prices stood at US$4.93, down 27.9% from the same month in 2018.

Slim chances of semiconductors falling into structural recession

The export outlook for semiconductors – which account for around 20% of South Korea’s total exports – does not appear bright. But most observers predicted the decline would fall back to the single digits in the second half of the year as global supply and demand is adjusted. The overall assessment among experts was that prices would continue dropping for some time, but the possibility of the semiconductor economy entering a structural recession is slim.

According to a Korea Institute for Industrial Economics & Trade (KIET) report published the same day on “2019 Semiconductor Market Trends as Seen by Semiconductor Industry Experts,” 46.2% of 26 semiconductor experts surveyed (11 analysts and 15 association and other group members) predicted the 2019 semiconductor market would be “worse than last year, but better than average years,” while 34.6% predicted it would be “worse than last year, but at the same level as average years” and 11.5% of the experts predicted the level would be lower than average years.

As a reason for the overwhelming number of experts predicting equal or better performance compared to average years, KIET explained that they expected to see rising PC and smartphone demand, an increase in data center building in the second half of the year, and proactive supply adjustments by producers. Experts predicted an average decline of 24% in memory semiconductor prices, with semiconductor exports dropping by an average of 16.9% in the first half of the year and 6.1% in the second. For the study, KIET commissioned FN Guide and the market research firm Metrix to conduct online and telephone surveys from Feb. 18 to 22.

Unforeseen shock to semiconductors could ripple throughout entire economy

Given the heavy reliance on semiconductors, analysts stressed the need for preparations.

“An unforeseen shock could have a huge impact on the economy and industry as a whole,” KIET warned.

“In light of the increasingly hot pursuit of China and other developing economies in technology terms, efforts should be made to sustain technological competitiveness, and the government and related institutions will need to make efforts to facilitate shared growth between semiconductors and other mainstay industries through inter-industry technology convergence, among other approaches,” it advised.

Meanwhile, export receivable-backed loans by Shinhan Bank and Kookmin Bank (KB) were initiated the same day in accordance with “export vitality promotion measures” announced on Mar. 4 by the South Korean government, with the Korea Trade Insurance Corporation (K-SURE) acting as a guarantor. K-SURE issued a first set of guarantees to the two banks, with additional ones to be issued to KEB Hana Bank and Woori Bank between Apr. 8 and 12. New financial products are also scheduled for launch, including loans based on export “contracts.”

By Choi Ha-yan, staff reporter

Please direct comments or questions to [english@hani.co.kr]