Posted on : May.22,2019 17:02 KST

|

|

Huawei’s logo

|

Samsung Electronics currently battling with Chinese firm for dominance in smartphone industry

|

|

Huawei’s logo

|

South Korean companies are enjoying mixed fortunes in the wake of the US government’s sanctions against the Chinese company Huawei.

The ripple effects were visible in the South Korean stock market, where Samsung Electronics – which is currently battling with Huawei for dominance in the global smartphone market – experienced a boost to its share prices on May 21, while LG U+, which relies on Huawei for supplies of communication equipment, saw its share prices fall.

According to accounts on May 21 from capital market and IT industry sources, many are predicting “reflexive gains” for Samsung Electronics, which is currently working to spur sales of its 5G smartphone.

“Huawei has had a major impact on Samsung Electronics’ declining smartphone market share in Western Europe and emerging markets,” said Hyundai Motor Securities analyst No Geun-chang.

“The Huawei issue is going to be an excellent opportunity factor for Samsung Electronics and its affiliates in terms of growing market share,” he predicted.

|

|

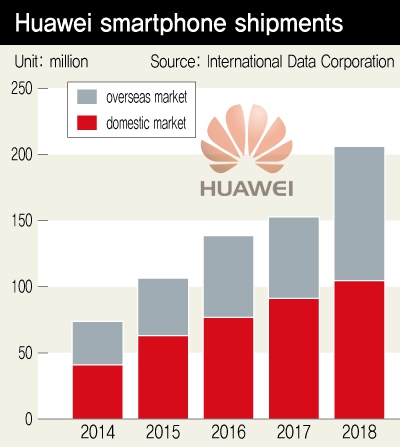

Huawei smartphone volumes

|

Analysts anticipate the negative impact of suspended transactions with US companies such as Google on Huawei smartphones represents an opportunity for Samsung Electronics.

Data from the market research firm Strategy Analytics showed Samsung Electronics remaining in first place with a 21.7% share of the global smartphone market in the first quarter of 2019, but with Huawei in close pursuit, brushing past Apple with a 17.9% share.

But the situation is not entirely simple. Huawei’s dominance of the domestic market in China could intensify if the local outcry against the US escalates into “patriotic” gestures. Samsung Electronics narrowly recovered its share of just under 2% of the Chinese smartphone market in the first quarter – the biggest barrier there being the high market share of Chinese smartphone companies. Huawei alone holds down a 33.7% share; when other Chinese companies such as Vivo, Oppo, and Xiaomi are factored in, the percentage rises to 85.1%.

A slump in Huawei smartphone phones could also backfire on Samsung Electronics, which supplies semiconductors to the company. Conversely, it could benefit from Huawei increasing its volumes from Samsung Electronics in place of US semiconductors. SK Hynix, which also supplies parts, is in a similar situation. Korea Investment & Securities analysts Cho Cheol-hee, Yu Jong-woo, and Kim Jeong-hwan noted, “Among memory semiconductor companies, SK Hynix accounts for a high percentage of Huawei supplies.”

“There could be negative effects in the short term,” they predicted.

Some analysts predicted the effects on parts suppliers would be limited.

“Samsung Electronics, SK Hynix, Samsung Electro-Mechanics, and LG Innotek have estimated relative sales percentages below 5% with Huawei,” said KB Securities analyst Kim Dong-won.

“The effects of a slump in Huawei’s smartphone sector will be minimal,” he predicted.

But with a campaign in China to boycott Apple products, negative effects could be in store for LG Innotek, LG Display, and Samsung Electro-Mechanics, which supply parts to Apple.

Concerns have also been voiced over potential losses to South Korean companies that receive communications equipment from Huawei, including LG U+. With Huawei using US parts to produce 5G communications equipment for LG U+, observers are predicting possible setbacks in obtaining additional volumes or managing existing equipment if the parts supply pathway is blocked.

In response, an LG U+ official said, “Huawei has reportedly already stockpiled ample volumes with its base station equipment and elsewhere in anticipation of this kind of situation, and finished preparations on its own independent parts development.”

By Song Gyung-hwa, staff reporter

Please direct comments or questions to [english@hani.co.kr]