Posted on : Apr.16,2018 17:49 KST

|

|

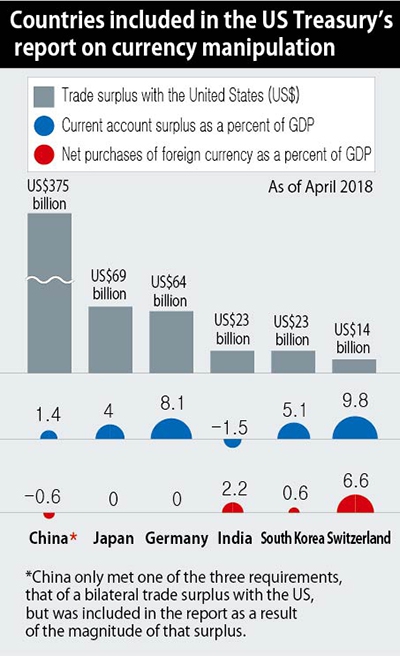

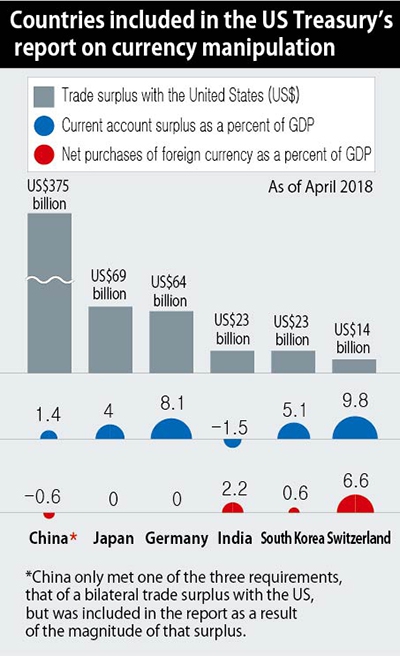

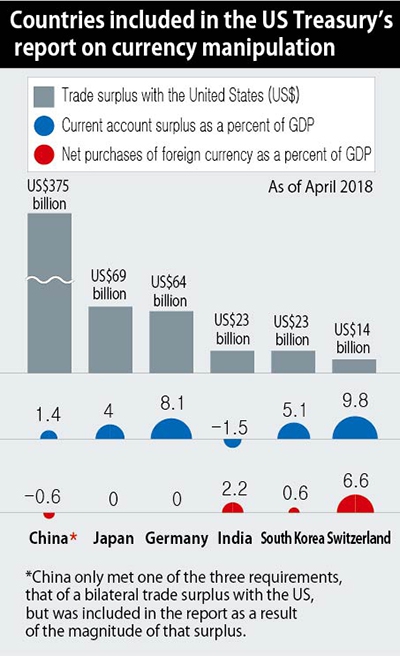

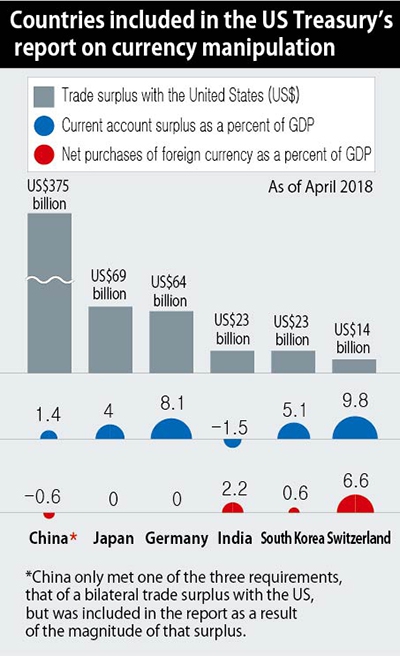

Countries included in the US Treasury’s report on currency manipulation

|

Treasury Department demands that Seoul disclose the details of its foreign exchange market interventions

|

|

Countries included in the US Treasury’s report on currency manipulation

|

The US placed South Korea on its monitoring list for currency manipulation as in past years – but also made explicit demands for it to disclose the particulars of its foreign exchange market interventions. With Seoul now in a position where it is unlikely to be able to hold out much longer, the questions of how and how often it will disclose information about its interventions is emerging as a major issue.

In its Apr. 13 “Foreign Exchange Policies of Major Trading Partners of the United States” report, the US Treasury Department placed South Korea on its “monitoring list,” a level down from its “enhanced analysis” list of currency manipulators. The Trade Facilitation and Trade Enforcement Act of 2015 lists three criteria for designation as a currency manipulator, namely a bilateral trade surplus of at least US$20 billion with the US, a current account surplus of at least 3% of GDP, and net purchases of foreign currency totaling at least 2% of GDP.

A country that meets all three criteria is designated a currency manipulator, while one that meets only two is placed on the monitoring list. South Korea has a trade surplus of US$23 billion with the US and a current accounts surplus totaling 5.1% of GDP, while its net purchases of US dollars on the foreign exchange market total 0.6% of GDP. The US publishes exchange reports every April and October, with South Korea placed on the monitoring list for five straight reports since Apr. 2016. The latest monitoring list added India alongside previous members South Korea, China, Japan, Germany, and Switzerland; no country was designated for enhanced analysis.

Stressing that foreign exchange market interventions should be limited to “only exceptional circumstances” involving disorderly market conditions, the report urged the South Korean government to publish details of its interventions in a transparent and timely manner. The call for “full transparency of foreign exchange operations,” which was not present in the previous Oct. 2017 report, is a demand for foreign exchange authorities to disclose the specifics of their “smoothing operations” to prevent fluctuations in the won’s value by buying and selling dollars.

Foreign exchange authorities and other observers concluded South Korea will most likely be unable to continue insisting on a policy of nondisclosure. South Korea is also the only member of the OECD and G20 that does not publish details on its interventions. The major issues going ahead can be summed up in terms of how much information it will provide, how often, and in what way.

“Some countries disclose foreign exchange market intervention details on a daily, monthly, or quarterly basis, and some Trans-Pacific Partnership (TPP) members do it on a six-month basis,” Deputy Prime Minister and Minister of Strategy and Finance Kim Dong-yeon noted on Apr. 13, adding that the matter would be “decided as an extension of past discussions.”

A multilateral trade agreement, the TPP was established under US leadership, but current President Donald Trump official announced the US’s withdrawal from it three days after taking office in Jan. 2017. The remaining 11 countries have since signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), but the likelihood of the US participating has grown since Trump’s recent announcement that he was considering returning to it.

South Korea set to decide soon on whether to joint Trans-Pacific Partnership

South Korea, which plans to make a decision within the first half of the year on whether to join, is also closely watching the TPP exchange rate agreement. A 2015 “Joint Declaration of the Macroeconomic Policy Authorities of Trans-Pacific Partnership Countries” states that members are to disclose foreign exchange market interventions (total purchases and sales) on a quarterly basis. Because countries such as Malaysia, Singapore, and Vietnam were disclosing intervention information for the first time, an agreement was reached to have them disclose only net purchasing (the total of sales and purchasing) on a twice-a-year rather than quarterly basis.

Like those countries, South Korea prefers to disclose only net purchases, and only after some time has passed, in order to minimize possible impacts on the currency market. The very publication of details about its interventions could diminish the government’s adjustment capabilities and contribute to exchange rate volatility – a burden that only grows larger when the publication periods are shorter and the approach more specific. The ability to predict intervention patterns also presents the risk that speculators will take advantage.

But with the TPP specifying quarterly disclosures of total net purchases and sales as a rule, the South Korean government has much to think about. In contrast with the emerging economies of East Asia, major economies like the United Kingdom and Japan publish their figures one month after the fact.

A senior official at the Ministry of Strategy and Finance said the decision on the timing and method of disclosure would “take into account the full range of factors, including the maturity of our foreign exchange market, economic structure, and the examples of other countries.”

Kim Dong-yeon is currently scheduled to discuss the issue at a G20 Foreign Ministers’ Meeting and Spring Meetings of the International Monetary Fund and World Bank in Washington, DC, on Apr. 19–23.

By Jung Eun-ju and Heo Seung, staff reporters

Please direct questions or comments to [english@hani.co.kr]