|

|

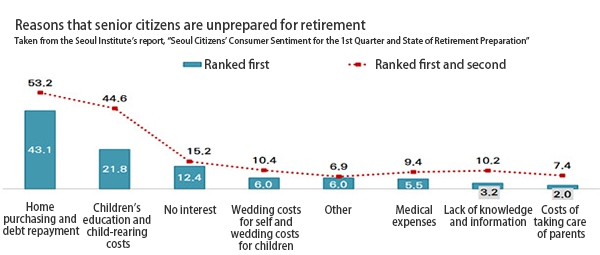

Reasons that senior citizens are unprepared for retirement

|

Home purchasing and debt repayment are cited as the most common financial issues facing seniors

Seoul residents envision an average of 2,515,000 won (US$2,340) as appropriate monthly retirement living costs for a married couple, a survey shows. But close to half of respondents said they were either “not prepared” (28.9%) or “going to prepare” (14.6%). Home purchasing and debt repayment demands were cited as reasons for difficulties in preparing for retirement. The Seoul Institute released findings on Mar. 26 for a survey of perceived economic conditions among Seoul consumers for the first quarter of 2018 and Seoul residents’ preparations for retirement. The results showed 46.6% of Seoul residents agreeing that appropriate post-retirement living costs would range between 2 and 3 million won (US$1,860–2,790). Most respondents said they planned to prepare for retirement through the National Pension or another public pension (49.5%) or a personal pension (25.0%). The main reason cited for not preparing post-retirement funds was “home purchasing and debt repayment” (53.2%). A total of 65.7% of households reported debt, an increase of 3.3 percentage points from the previous quarter. Respondents reported receiving loans for housing (52.9%), business (17.7%), and living costs (17.4%). The survey, which was conducted with 1,013 households in the city of Seoul, showed 40.0% of respondents naming “job support policies for older people” as the most urgently needed retirement-related measure. Other measures included “expanded healthcare and welfare services for senior citizens” (20.6%), “an expanded state responsibility system for dementia” (17.8%), and “increases in the amount and targets for the basic old age pension system” (11.9%). By Nam Eun-joo, staff reporter Please direct questions or comments to [english@hani.co.kr]