|

|

1

|

Statistics show top 1% inherited US$3.5 mln per person in 2017

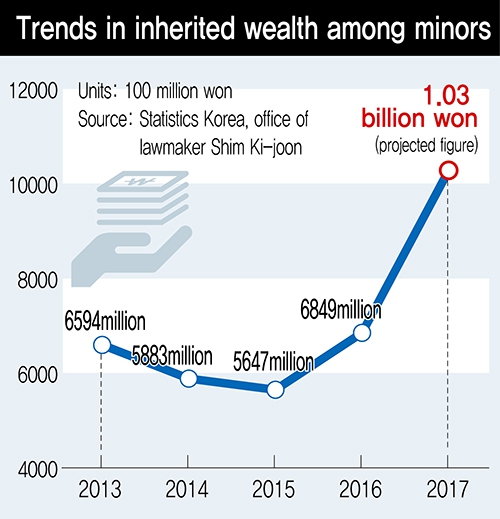

8,139 persons. This was the total number of homeowners aged ten and under listed in South Korea as of late 2016. In terms of the population for the corresponding age group, it amounts to around one in 600. Of the number, 350 lived in one of Seoul’s three Gangnam districts (Gangnam, Songpa and Seocho), while 25 were listed as owning five or more homes. Contained in data received from Statistics Korea by the office of Democratic Party lawmaker Shim Ki-joon, the numbers show the current state of affairs in a South Korea on the threshold of becoming a “hereditary society” where a person’s fate is determined by bloodline and birth rather than ability or effort – the “return to the Middle Ages” warned of by Paris School of Economics professor and “Capital in the Twenty-First Century” author Thomas Piketty. US$164.4 million a day inherited or gifted Tentative figures from the National Tax Service (NTS) put the total amount of assets inherited or given as “gifts” last year at 67.889 trillion won (US$59.8 billion) – including 32.1874 trillion won (US$28.4 billion) in inherited wealth and 35.7016 trillion won (US$31.5 billion) in gifts. The numbers translated into an average of 186 billion won (US$164.4 million) a day in property handed down from parents or grandparents to heirs who did nothing to earn it. According to NTS figures on inheritances by and gifts to minors between 2013 and 2017 and the calculation of comprehensive estate taxes for minors received by the Hankyoreh Economy & Society Research Institute (HERI) through the offices of lawmaker Shim Ki-joon, the amount of assets gifted to South Koreans under age 19 last year was tentatively calculated at 1.0279 trillion won (US$906 million). The largest chunk was in the form of real estate at 337.5 billion won (US$297.4 million), followed by financial assets (328.1 billion won/US$289.1 million) and negotiable securities (237.0 billion won/US$208.9 million). By age group, 46.8% of recipients were aged ten and under – accounting for 481.1 billion won (US$424.0 million). The amount gifted to minors in 2017 was up 50% from 684.9 billion won (US$603.6 million) in 2016. That year, a total of 167 minors paid the comprehensive real estate tax. The number of minors paying that tax has been growing from year to year, climbing from 136 in 2013 to 154 in 2014 and 159 in 2015. As the scale of the economy grows, it stands to reason that the amount of assets inherited or given as gifts will rise as well. The problem is that the percentage of inherited or gifted assets out of all South Korean national income fell in the 4–5% range in the 2010s – the highest it has ever been. Even those numbers are based on appraised land values and may not fully reflect the reality. Dongguk University economics professor Kim Nak-nyeon estimated that the proportion of inherited and gifted assets out of national income may already fall in the range of 8–10% if factors such as age group mortality rates are considered. While it may not have yet reached the level of 20% recorded in Western European countries in the early 20th century – when the percentage of inherited and gifted assets was at its highest in history – it has been growing at a fairly fast pace. Assets: the ‘one ring to rule them all’ The situation is a symbolic illustration of the crucial role assets play in increasing inequality in South Korea. The increased percentage of previously accumulated wealth (assets) compared to newly earned wealth (income) is clearly shown in the so-called “Piketty ratio” of private assets (wealth) to income. The ratio of net assets for households and non-profits according to the Bank of Korea balance sheet to net national income (NNI) rose from 5.48 in 2010 to 5.76 last year. The main cause has lay in rising real estate prices. Recent Korea Institute for International Economic Policy figures showed a price-to-income ratio (PIR) of 11.2 for housing in Seoul as of the third quarter of 2017. Even a simple comparison shows the number to far outstrip South Korea’s ratio of private assets to income. It translates into an average of 11.2 years that a person would have to save up annual household income without any spending to be able to purchase a home in Seoul. The ratio is well ahead of either London’s (8.5) or Tokyo’s (4.8). Accurate information on the scale and distribution of assets is very hard to come by. But most experts agree that the South Korean trend – as in other countries – is one of growing asset inequality. Based on an analysis of NTS inheritance tax figures, Kim Nak-nyeon estimated that South Korea’s wealthiest 0.1%, 1%, and 10% respectively accounted for 9.2%, 26%, and 66.4% of all assets in 2013. The percentage owned by the top 10% was lower than in the US (77%) or United Kingdom (70%) and higher than in France (62%). Kim concluded that the concentration of wealth with the top 10% was increasing at a rate approaching that of the UK and US. Asset inequality is a direct cause of disparities in income earned from asset ownership. A calculation by HERI based on NTS figures showed the top 10% accounting for 50.7% of real estate rental income and 90.8% of interest income in 2016. The top 10% also accounted for fully 94.4% of dividend income (14.863 trillion won/US$13.1 billion). Rental income earned by the top 1% the same year averaged 357.12 million won (US$314,700) per person. As of Aug. 2018, a total of 8,691 rental business operators, or 2.5% of all such operators nationwide, owned 20 or more homes. Part of vicious cycle perpetuating and exacerbating inequality

|

|

Trends in inherited wealth among minors

|