|

|

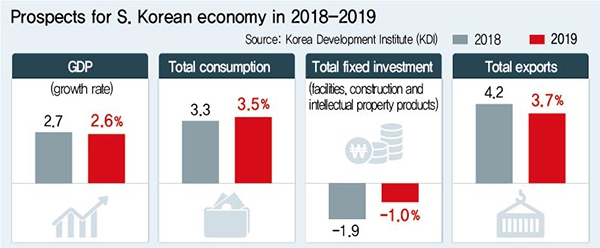

Prospects for S. Korean economy in 2018-2019

|

Government think tank cites manufacturing and construction slump and lagging service industry

The Korea Development Institute (KDI), a government-funded think tank, has warned that the South Korean economy’s growth rate is unlikely to rise above 3% unless the country’s industrial competitiveness is strengthened. The gradual weakening of the growth trend is due, the KDI believes, to sluggish growth in the manufacturing industry, slowing improvement in the service industry and a slump in the construction industry. The KDI recommended smoothly implementing the expansionary budget drafted for next year while maintaining the current level of easing in monetary policy. These conclusions appeared in “Economic Forecasts for the Second Half of 2018,” a report that the KDI released on Nov. 6. First of all, the KDI predicted that the South Korean economy’s growth rate for next year will be 2.6%, down 0.1 percentage point from its May projection of 2.7%. This drops below South Korea’s potential growth rate (2.7-2.8%), referring to the greatest amount of growth possible. The growth rate for this year, originally projected to be 2.9%, has also been revised downward by 0.2 percentage points to 2.7%. “There are [already] clear signs that the economy has passed its zenith and that growth is slowing,” said Kim Hyeon-uk, the KDI’s chief of economic projections, while explaining the reasons for the downward adjustment of the growth rate projection. Previously, the Bank of Korea predicted that next year’s growth rate would be 2.7%, the same as this year. The International Monetary Fund (IMF) and the Organization for Economic Cooperation and Development (OECD) have made projections of 2.6% and 2.8%, respectively for South Korea’s growth rate next year. The KDI predicted that there will be a gradual slowdown across all sectors of the economy, including consumption, investment and exports. Consumption in the private sector increased by 2.8% this year, but the KDI predicts that the rate of increase will drop to 2.4% next year. Consumption ability is expected to decrease because of the burden of repaying household debt and falling asset prices. Last year, total fixed investment (that is, investment in facilities, construction and intellectual property products) increased by 8.6%, but the rate of change reversed this year (-1.9%), and the economy is unlikely to escape negative territory (-1.0%) next year. Not only has the atypical boom in facility investment in the semiconductor sector come to an end, but construction investment will also decrease by a considerable amount (-3.4%) next year. With the high growth in exports in particular sectors, including semiconductors, being blunted, exports next year are also expected to post a growth rate of 3.7%, somewhat lower than this year’s rate (4.2%). Stagnation in employment projected to continue The KDI’s prognosis is that the employment market is also unlikely to improve for the time being. The KDI expects the nation’s workforce to increase by 70,000 this year, which is 130,000 fewer than its May forecast of 200,000. Furthermore, the workforce is expected to remain static during the fourth quarter of this year (October through December) and to increase by around 100,000 next year. This is in sharp contrast to the 300,000 people who were entering the workforce each year, a trend that continued until last year. “This appears to reflect the near-term side effects of policies related to wages and working hours that can increase companies’ labor costs,” said analyst Jeong Gyu-cheol, referring to the government’s decision to raise the minimum wage and reduce working hours. Based on these economic forecasts, the KDI called on the government and the Bank of Korea to make a range of policy responses. First of all, it urged the government to more energetically pursue restructuring policies aimed at expanding the economy’s growth potential. Short-term economic stimulus measures, the KDI said, will be limited in their ability to reverse the slowdown in economic growth. The need for strengthening industrial competitiveness The KDI also warned that a delay in the recovery of industrial competitiveness through restructuring major industries and regulatory reform could make it difficult to sustain policies aimed at alleviating income inequality and creating jobs. The institute underlined the need to maintain the current level of easing in monetary policy. More specifically, the institute’s opinion is that it is not advisable to move toward austerity measures, such as raising the benchmark interest rate, even if housing prices in the Seoul area soar or if credit risks increase in certain parts of the financial sector. “Since the domestic and foreign economic conditions do not warrant optimism and there are concerns about uncertainty abroad, long-term policy should be focused more on structural reform and strengthening industrial competitiveness [than on monetary policy],” Kim Hyeon-uk said. By Jeong Eun-ju and Bang Jun-ho, staff reporters Please direct comments or questions to [english@hani.co.kr]