Posted on : Dec.20,2018 17:27 KST

|

|

A sunrise viewed from the Koryo Hotel in Pyongyang. (photo pool)

|

Expert on North Korean investment highlights the potential behind North’s new economic policy

“Expanding and developing economic and technical cooperation and exchange under the principles of equality and reciprocity with various countries around the world is the DPRK’s [North Korea] consistent policy. [. . .] Companies from various countries have been becoming more excited about investment. It is our hope that this will contribute to investment by giving foreign investors an adequate understanding of the DPRK’s foreign economic legislation and institutions, its investment policy and the investment environment.”

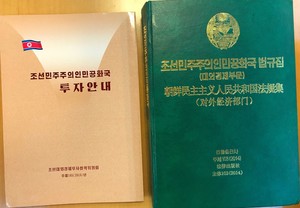

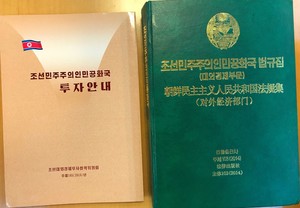

This passage appeared in the preface to one of the North Korean pamphlets that Choi Jae-ung, 39, an attorney with the legal firm Barun Law, brought with him during an interview with the Hankyoreh on Dec. 18. The pamphlets were titled, “DPRK Laws Related to the Foreign Economy” and “An Investment Guide to the DPRK,” published by the North Korean Foreign Investment and Economic Cooperation Committee in 2014 and 2016, respectively.

|

|

Attorney Choi Jae-ung

|

On Nov. 30, a book titled “Interpreting North Korean Investment Laws” was released by the publisher Pakyoungsa. The authors were Choi and four other attorneys on the North Korean investment team at Barun Law. This book covers four laws related to investment in North Korea by South Korean companies, including the Inter-Korean Economic Cooperation Act; seven laws related to investing in North Korea by foreign companies, including the Joint Venture Act, passed in 1984; and six other laws related to investment, including the Customs Act and the Land Rental Act. This is the first book in South Korea that covers the whole range of laws related to investing in the North.

Shift from border area economic zones to centralization in Pyongyang

|

|

A book titled “Interpreting North Korean Investment Laws,” authored by five attorneys on the North Korean investment team at the legal firm Barun law and published by Pakyoungsa

|

“During the rule of Kim Jong-il, special economic zones were established in border areas far from Pyongyang or in Kaesong, Sinuiju, Rajin and Sonbong. But under Kim Jong-un, the economic development zones that are at the heart of Kim’s strategy of opening up to the outside world are clustered around Pyongyang. North Korea is getting bolder in its policy of attracting investment as it gradually moves toward the capital at the center,” Choi said.

“We need to move beyond our perspective on national cooperation and approach investment in North Korea from the understanding that the North is an attractive investment, which is to say an emerging market. Emerging markets offer a high return on investment, but the risk is just as great. In order to objectively and rationally assess North Korea’s investment value, figure out how to hedge against risk and learn how to minimize risk in the post-investment exit, you’ve got to look into investment-related legislation.”

Choi is a “China hand” who worked at a local law firm in Beijing and an expert in making deals who has handled merger and acquisition contracts for several South Korean firms.

The distinction between South Korean and international capital in N. Korean law

|

|

Pamphlets titled, “DPRK Laws Related to the Foreign Economy” and “An Investment Guide to the DPRK,” published by the North Korean Foreign Investment and Economic Cooperation Committee in 2014 and 2016, respectively.

|

One distinctive facet of North Korea’s foreign investment legislation is its dualistic nature. A direct investment by a South Korean company falls under the Inter-Korean Economic Cooperation Act, but investment by foreign capital from another country falls under the Foreign Investment Act.

“This can be an advantage when selecting the investment structure that’s optimal for reducing the risk that North Korea presents certain countries. All you have to do is choose the option that offers preferential conditions for investment. In other words, a South Korean company can partner with Chinese capital and enter North Korea with Chinese affiliation, or it can access North Korea as a multinational joint venture. On the other hand, if foreign investors conclude that the provisions of the Inter-Korean Economic Cooperation Act work in their interest, they can set up a joint venture in South Korea and invest in North Korea with South Korean affiliation,” Choi said.

A South Korean non-profit called the North Korean Legislation Research Society that has been printing copies of North Korea’s legal code for academic purposes prompted the North Korean government to contact the South and complain that it isn’t being paid royalties under copyright law. This shows that North Korea is becoming more interested in opening up its market and private ownership, including intellectual property rights.

“I heard that the Chinese police recently visited the Beijing office of KOTRA [Korea Trade Promotion Corporation]. They mistakenly thought that payments of a newspaper subscription to South Korean newspaper, the Chosun Ilbo, were going to North Korea, which is called ‘North Chosun’ in Chinese. I’m also told that a large number of members of North Korea’s lawyer association of lawyers visited China to ask Chinese companies to invest in the North,” Choi said.

By Cho Kye-wan, staff reporter

Please direct comments or questions to [english@hani.co.kr]